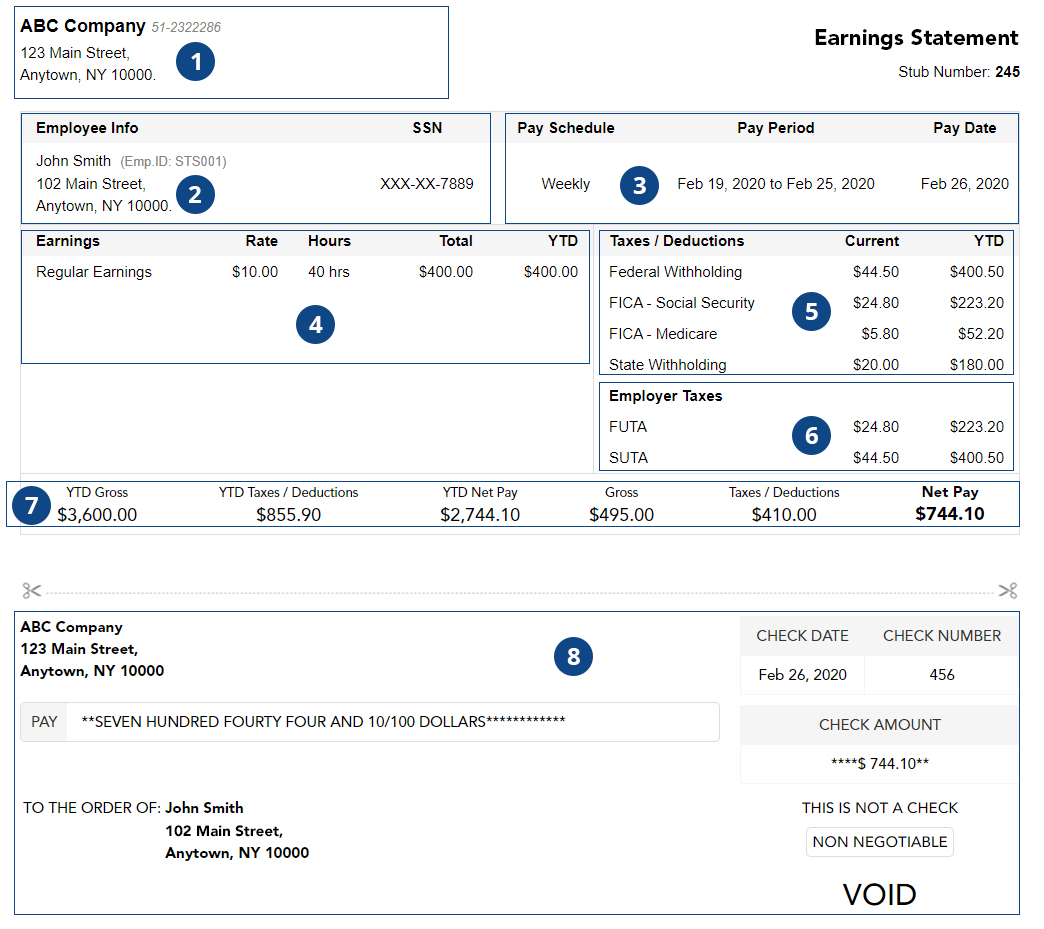

What information is included on Pay Stub?

- Updated on Feb 08, 2023 - 11:00 AM by 123PayStubs TeamA pay stub is a proof of payment made to the employee, which itemizes the earnings and deductions for a particular pay period and the year-to-date total.

Click on a number to learn more about the section of a pay stub.

1. Employer Information

This section includes information about the employer such as Company Name, EIN, and Company Address. Some businesses opt to include the company logo in the pay stub.

2. Employee Information

This section lists information about the employee such as Name, Address, and last four digits of SSN.

3. Pay Period Information

Here you can find the information about the pay schedule, pay period, and pay day.

- Pay schedule: The schedule how often the employee is paid regularly

- Pay period: The time frame during which the employee worked.

- Pay day: The day the employee receives wages for the pay period.

Click here to know the difference between Payday, Pay schedule, and Pay period.

4. Earnings for the period

This includes the wages earned by the employee for the pay period and year-to-date (YTD). It also includes hours worked and the rate paid. The common earnings types are as follows

- Regular earnings: Earnings for regular work.

- Additional earnings: Earnings other than regular pay such as an award, back pay, tips, commissions, bonus, on call pay, overtime, etc.

- Time off: Sick pay, vacation pay, and holiday pay.

5. Deductions and Taxes

This section helps you understand pay stub deductions. This lists the statutory deductions and taxes applicable to the pay period. This includes federal withholding, FICA taxes (Social security and Medicare), and state withholding. This may include state, city, and local deductions such as state disability insurance and family leave benefits if mandated.

6. Employer Taxes

This includes taxes paid by the employer for the pay period such as FUTA & SUTA taxes. It may also include taxes paid by the employer specific to a state, city, or jurisdiction.

7. Gross and Net Pay

Here you can find the employee’s gross pay, taxes & deductions, and net pay for the pay period and YTD.

8. Deposit Slip

This section contains a copy of the voided check with the employee’s net pay for the record.

Still have questions about our online paystub generator?

Reach out our customer support team by chat or email for any questions that you may have regarding our paystub generator.