Advantages of Filing Form W-2 Online With 123PayStubs

Here are some of the best benefits you’ll get when you choose to e-file Form W-2 through 123PayStubs.

Form Validation

Your forms will be validated against the IRS business rules in order to reduce the chances of form rejection.

Mail Employee Copies

Opt for postal mailing and we’ll send copies of Form W-2 to your employees on your behalf.

Instant Filing Status

Once the SSA processes your return, you’ll be notified of your return status by email.

Form W-3

While filing your W-2 forms, Form W-3 will be generated automatically for your record-keeping purposes.

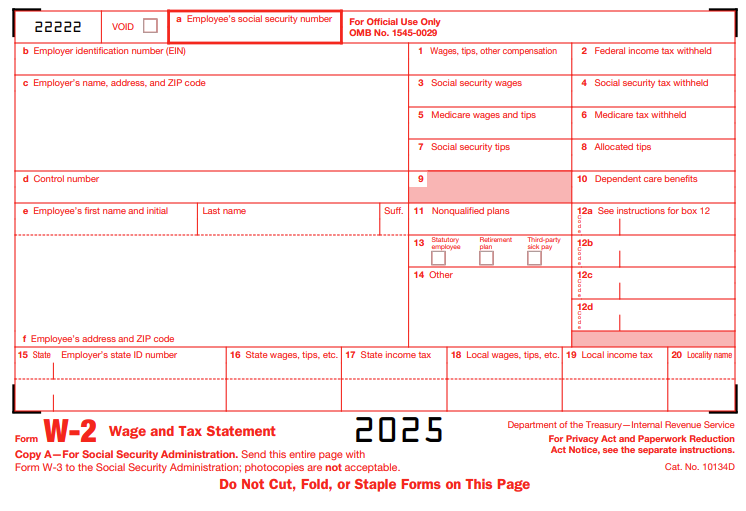

What Information is Needed to E-File Form W-2?

Before you begin to e-file Form W-2, collect the information below and keep it handy:

- 1. Employer Details: Name, EIN, Employer Type, and Address

- 2. Employee Details: Name, SSN, Address, and Contact Information

- 3. Federal Details: Federal wages and federal income tax withheld

- 4. FICA Details: Social security and Medicare taxes withheld

- 5. State Details: State wages and state income tax withheld

- 6. Local Tax Details: Local, city or other income tax withheld

Have these information ready? File your Form W-2 in less than 2 minutes.

How to E-File Form W2?

You can e-file Form W2 with the SSA by following a few simple steps. Here’s how to e-file Form W-2 using 123PayStubs.

1. Form W-2 Information

Enter the form information including employee and employer info, federal and state wages info, and federal and state taxes withheld.

2. Review Form W-2

Review form and edit if there are errors in the return.

3. Transmit Form W-2 to SSA

Transmit the return to the Social Security Administration (SSA).

E-file Form W-2 as simple as 1-2-3!

Frequently Asked Questions on Form W-2

What is Form W-2?

Form W-2 is a wage and tax statement filed with the Social Security Administration (SSA) to report the wages paid to employees and taxes withheld (federal and state income tax, social security, and Medicare) from them during a calendar year. After filing the return with the SSA, employers must also send a copy of Form W-2 to the corresponding employees so that they can file their year-end taxes.

When is the deadline to file Form W-2?

Form W-2 must be filed on or before February 02, 2026, with the SSA. You can choose to file the return electronically in order to save time and ensure the return is error-free. Please note that a copy of Form W-2 must be sent to employees before February 02, 2026.

Should I need to file Form W-3?

If you e-file Form W-2 through 123PayStubs, you need not file Form W-3 as we’ll send it directly to the agency. However, we still auto-generate Form W-3 for your records, which you can view and download from the Dashboard.

Who must file Form W-2?

If you have one or more employees to whom you made payments for their services in business or trade, you must file Form W-2. That is, you must file Form W-2 if you have:

- Withheld any Social Security, Medicare tax, or federal income tax from employee paychecks

- Paid $600 or more wages, even if income, social security tax, and Medicare tax isn’t withheld