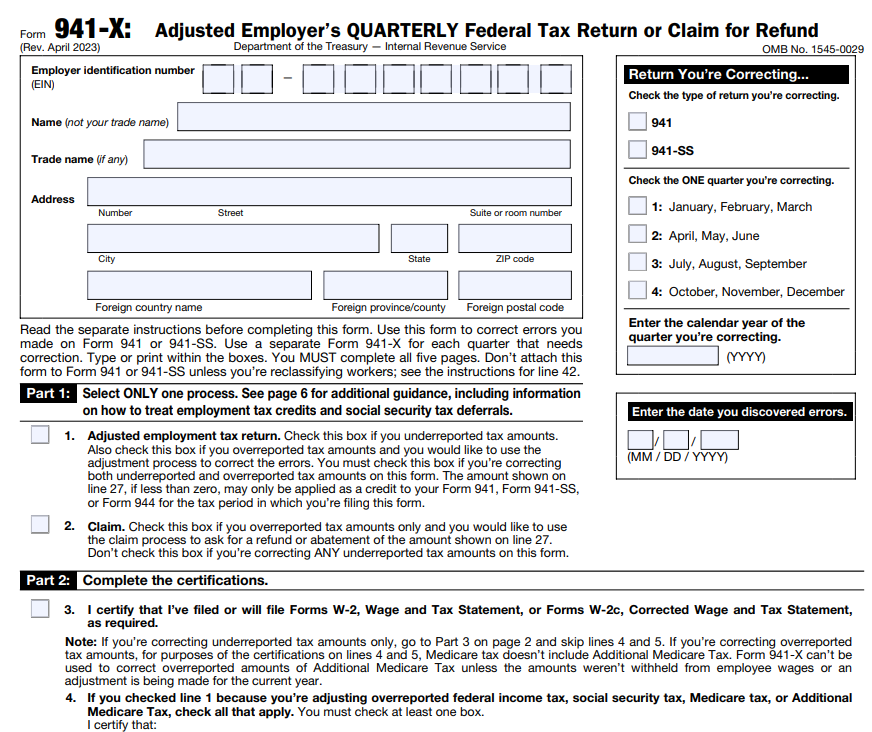

How to Create Free Fillable Form 941-X for 2023?

Enter the Information

Enter the required form information such as employer identification number (EIN), business name, trade name (if applicable), and business address.

Enter the Corrections

The errors that can be corrected in Form 941-X are for underreported amounts, overreported amounts or both.

Review & Download Form

After you’ve completed filling out Form 941-X, you can review your form for any mistakes or typos before you download it.

Frequently Asked Questions on Form 941-X?

What is Form 941-X?

Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund is used to correct errors on Form 941 that you previously filed. With Form 941-X, you can correct errors made in

- Employee wages

- Income tax withheld from wages

- Taxable social security wages

- Taxable social security tips

- Taxable Medicare wages and tips

- Taxable wages and tips subject to Additional Medicare Tax withholding.

Can I file Form 941-X electronically?

No, The IRS does not accept 941-x returns electronically. You must submit your return in the mail.

When is the deadline to file Form 941-X?

There is no specific deadline for filing Form 941-X. You must file this form when you find any errors in your previously submitted Form 941. However, there is a general time frame to report overreported and underreported taxes.

For overreported taxes, you should file Form 941-X within 3 years of the date that the original Form 941 was filed or 2 years from the date you paid the tax reported on Form 941.

For underreported taxes, you should file Form 941-X within 3 years of the date that the original Form 941 was filed.

How to make corrections in the Form 941?

For every correction you make on Form 941-X, you must explain each one. Your explanation for correction must include the following information:

- Form 941-X line number(s) affected

- Date you discovered the error

- Difference (amount of the error)

- Cause of the error

Still have questions about our online paystub generator?

Reach out our customer support team by chat or email for any questions that you may have regarding our paystub generator.