Advantages of Filing Form 1099-NEC Online With 123PayStubs

Here are the best benefits you’ll get when choosing 123PayStubs to eFile 1099-NEC.

Instant Filing Status

We will notify you of the return status via email once the IRS processes your return.

Form Validation

Our system will validate your tax returns based on IRS business rules to reduce the chances of form rejection.

Mail Recipient Copies

Choose our postal mailing option and we’ll send copies of Form 1099-NEC to your recipients on your behalf.

Form 1096

We’ll auto-generate your Form 1096 while you file Form 1099-NEC with us and send it to the IRS.

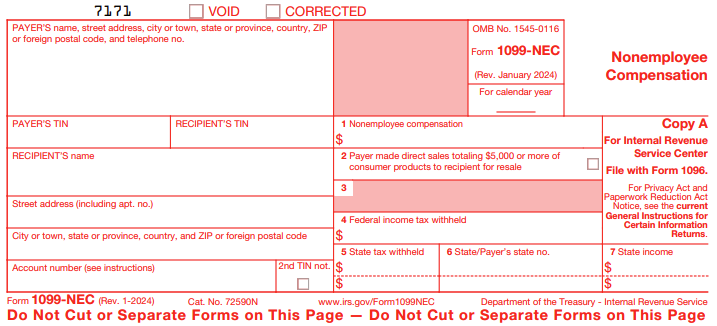

What Information is Needed to E-File Form 1099-NEC?

Below is the required information to file 1099-NEC online:

- 1. Payer Information: Name, TIN, and Address

- 2. Recipient Information: Name, SSN/TIN, and Address

- 3. Nonemployee compensation

- 4. Excess golden parachute payments

- 5. Federal income tax withheld

- 6. State Filing Information: State Income, Payer State Number, and State Tax Withheld

Have these details ready? Start filing your Form 1099-NEC in minutes.

How to E-File Form 1099-NEC Online?

E-file Form 1099-NEC with the IRS through 123PayStubs by following the simple steps below.

1. Enter Form Info

Enter the form information including payer and recipient info, nonemployee compensation, and federal income tax withheld.

2. Review Form

Review the form and make sure the information entered is correct. In case you find any errors, you may edit the return.

3. Transmit the Return to IRS

If everything is good, transmit the return directly to the IRS.

Start filing Form 1099-NEC. It’ll take only a few minutes.

It’s as simple as 1-2-3!

Frequently Asked Questions on Form 1099-NEC

What is IRS Form 1099-NEC?

Form 1099-NEC is filed to report payments ($600 or more) made to independent contractors (or nonemployees) for their services.

The following payments should be reported in Form 1099-NEC.

- Nonemployee compensation

- Excess golden parachute payments

- Federal income tax withheld

- State Income and Withheld

When is the deadline to file Form 1099-NEC?

The deadline to file Form 1099-NEC with the IRS and send recipient copies is February 2, 2026 (for both paper and electronic filing).

Are there any exemptions for filing Form 1099-NEC?

Yes, there are some scenarios where you don’t need to file Form 1099-NEC.

If you have paid

- C or S corporation,

- For the merchandise, telegrams, telephone, freight, storage, and similar items,

- Tax-exempt organisations, you are not required to file Form 1099-NEC.

When would you file a Form 1099-NEC?

You are required to file Form 1099-NEC if one of the following conditions met:

- You have paid someone other than your regular employee at least $600 in the calendar year.

- You paid an individual, partnership, estate, or, even, a corporation for their services. It also includes government agencies and nonprofit organizations.

Still have questions about our online paystub generator?

Reach out our customer support team by chat or email for any questions that you may have regarding our paystub generator.